11 Best North Dakota Native Automotive Insurance Coverage Companies

Table of Content

- Godfread Presents First-of-its-kind Health Care Research To Health Care Committee

- No-fault/pip Insurance

- Least Expensive Full Protection Automotive Insurance Coverage In North Dakota

- Insurance Coverage Commissioner Encourages North Dakotans To Organize For Flood Risk

- Senior Drivers: Cheap Auto Insurance For North Dakota Drivers Age Sixty Five To Eighty Five

His other insurance coverage merchandise embody owners' and life plans. DeVold has over 19 years of expertise within the monetary providers trade. The type of accident will determine what steps the claims division of your company will take next. If the claim includes private damage to you or your passengers, you will be required to complete a declare kind.

A loss of value is solely a reduction within the ACV of your car. A loss of worth could occur if you promote or trade a vehicle with a branded title. In some cases, the proprietor of the automobile with a branded title may obtain much less for the vehicle than he or she would have had the automobile not had a branded title, although the car has been repaired.

Godfread Presents First-of-its-kind Well Being Care Examine To Well Being Care Committee

Insurers can use your credit score data to underwrite your insurance coverage policy or to price your insurance coverage. Underwriting is a course of where an insurance coverage firm gathers info and decides whether or not or not you are eligible for their program. Rating is a process that determines how much you pay for insurance. Property and casualty policies, together with auto insurance policies, are not required to have a grace interval that enables for late cost of premium. The premium should be in the arms of the corporate on the date identified on the bill. If the premium just isn't obtained by that date, the coverage routinely terminates.

For occasion, should you get a quote for complete and collision coverage with a $1,000 deductible from one supplier, use these same limits whereas evaluating one other company’s costs. Nodak Mutual presents the most affordable automobile insurance in North Dakota at $203 per 12 months for state minimal coverage. By purchasing round for automotive insurance, you could proceed paying aggressive charges even with an at-fault accident on your North Dakota driving record. If you lease or finance your vehicle, then you may need to buy collision and complete protection to adjust to the terms of your mortgage. Lenders require this protection to guard your vehicle, which is the collateral for the loan. If you aren't leasing or financing your car, then full coverage automobile insurance coverage , is optionally available, although many drivers carry it for peace of mind.

No-fault/pip Insurance Coverage

The second methodology of settlement is to have the corporate adjuster put together an estimate that you may take to any shop you want. The third technique includes you voluntarily agreeing to take the car to a store that your company has a particular agreement with, known as a most well-liked shop. The firm has agreed to let the preferred shop prepare the estimate and full the repairs.

If the owner does not carry insurance coverage, your coverage turns into primary. One exception to this is when you are driving a automobile from a garage/car dealer operation, then your liability is primary. When you drive a vehicle you do not own, the usual auto coverage will present the identical protection for bodily damage that you have got on your own insured car. You must get the insurance firm that provided the inaccurate information to the loss historical past database to correct the entry.

Insurance Coverage Commissioner Godfread Appoints Ubben And Ost On First Day In Office

The bulletin urges companies to waive price sharing necessities for the testing of COVID-19 and encourages health insurance firms to evaluation different operations in preparation for COVID-19 doubtlessly coming to North Dakota. Insurance Commissioner Jon Godfread today introduced the North Dakota 66th Legislative Assembly Interim Health Care Study to the legislative Health Care Committee. During the 66th Legislative Session, the North Dakota Insurance Department was tasked with helping Legislative Management in conducting an interim examine of medical insurance premium trends.

Therefore, it would not be needed so that you just can buy the protection for physical harm offered by the car rental company. First, your insurance credit rating is a snapshot in time, and a significant change in your credit exercise or a creditor's report can change your rating. Second, insurance coverage credit score scores usually are not uniform amongst insurance companies. Insurance corporations have different views on which components are more essential based on their experience and enterprise practices. For instance, one company might feel that public data are extra necessary than previous fee history. Auto premiums are based mostly on other factors in addition to credit historical past.

He joins fundraising occasions that give back to the members of the community. The most cost-effective car insurance could not provide adequate protection, so how much insurance coverage do you have got to buy? Bare-bones protection could additionally be a good selection if you have few belongings or have an old automotive and don’t drive much.

Once the correction is made you could request the insurance coverage company to rethink your software. In fact, the agent or firm underwriter might not even know your score. Instead, all of your agent or underwriter might know is that your score qualifies you for a specific fee or company inside the group. Even if you know your insurance coverage credit score rating, it will not be helpful to you. The number of open strains of credit score (including the variety of major bank cards, division store bank cards, etc.) - having an excessive quantity of credit tends to have a adverse impact in your insurance coverage credit score rating. However, it usually isn't a good suggestion to cancel a credit score account that you've had for a long time.

Its longevity in the monetary sector allows it to supply one of the best insurance options that cater to shoppers' personal and industrial wants. Its team of agents provides auto insurance coverage that covers the house owners property and belongings when accidents happen. It also provides life, home, business, and farm insurance merchandise.

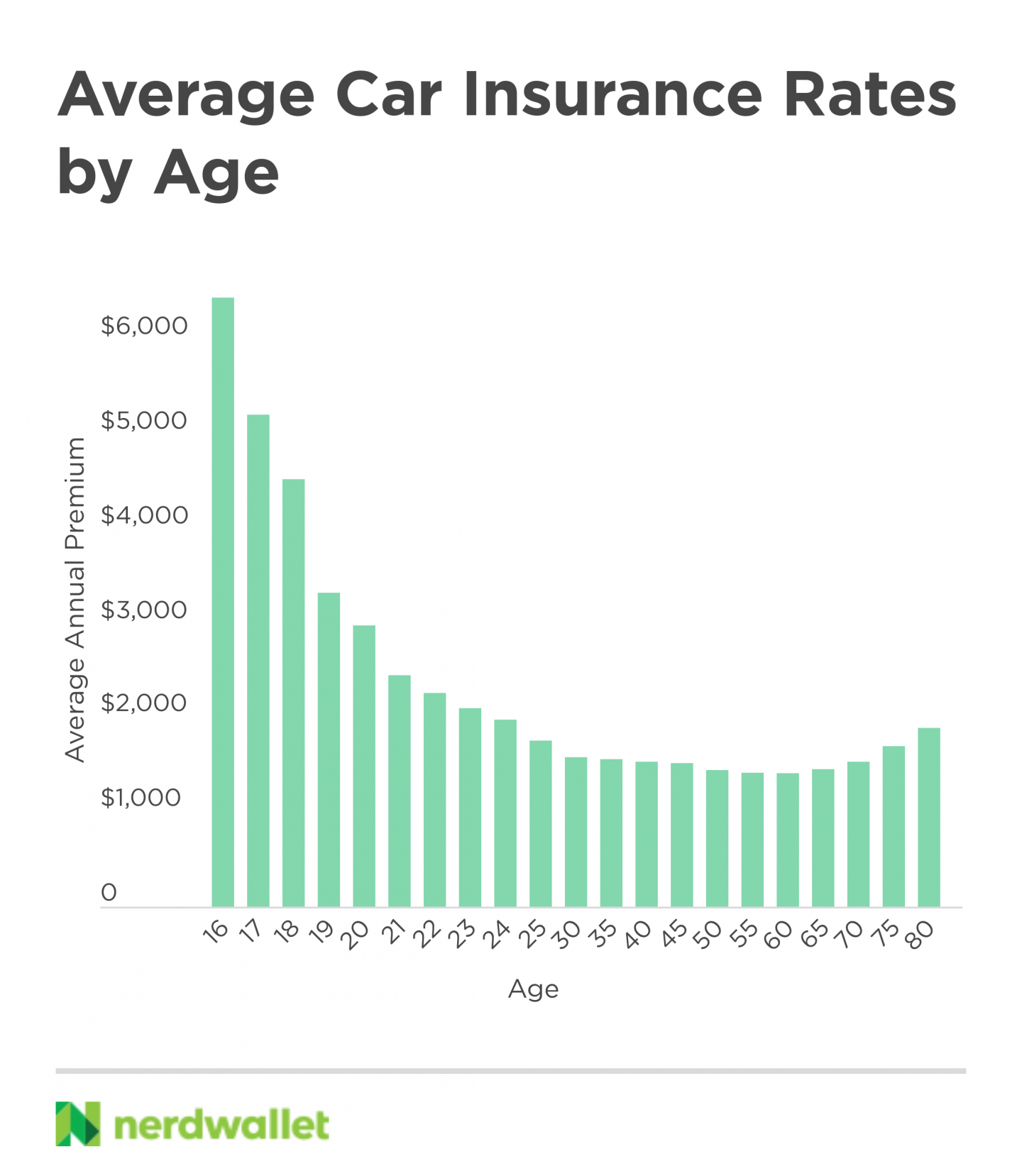

No matter the place you reside, adding a new driver to your family coverage will hike your fee significantly. In North Dakota, you possibly can expect your fee to go up by a mean of 139 p.c when including a driver age sixteen to your coverage, according to CarInsurance.com fee data. You’ll see in the table below how a lot it prices, on common, to add a teen driver in North Dakota, and the way major insurers examine on price. GEICO General had the lowest auto insurance coverage value for adding a driver age sixteen to a full protection family policy, amongst insurers surveyed. Your car insurance coverage premium might be determined by components distinctive to you.

AAA and its affiliated insurance coverage corporations have a robust presence in North Dakota, and the company is understood for offering aggressive costs across the state. Enter an age from 18 to 25 to see who has the most effective charges for young drivers in North Dakota, by firm. More than 10 years old, solely buy collision and comprehensive in case your automotive is worth $3,000 or extra, should you couldn’t afford to replace your automotive if it’s wrecked, or should you simply want more protection in your policy. Michelle is a writer, editor and professional on automotive insurance and personal finance.

The Department serves North Dakotans by assisting shoppers and companies with insurance coverage needs, investigating insurance coverage fraud, and regulating the insurance coverage trade in the State. In Bismarck, adding a 16-year-old daughter to your coverage will hike your charges by $1,164 annually, or 103% It’s extra for boys. Insuring your 16-year-old son will increase your yearly fee by $1,428, or 126% in accordance with CarInsurance.com fee information. Some corporations concentrate on offering protection for vintage cars. A good place to start when in search of this protection is to contact vintage car clubs or associations.

They depend on zip code, driving document, credit score score, and tons of different components. Bankrate analyzed rates from the Quadrant Information Services and found that theaverage value of automobile insurancein North Dakota was $285 per yr for minimum protection, whereas full protection averaged $1,264 per yr. USAA is the most affordable automotive insurance coverage possibility for army members and their households, averaging $167 per 12 months for liability coverage in North Dakota. The most costly auto insurance company for minimum protection is Allstate, costing $534 per year on average.

Comments

Post a Comment